Community First: A privilege to serve

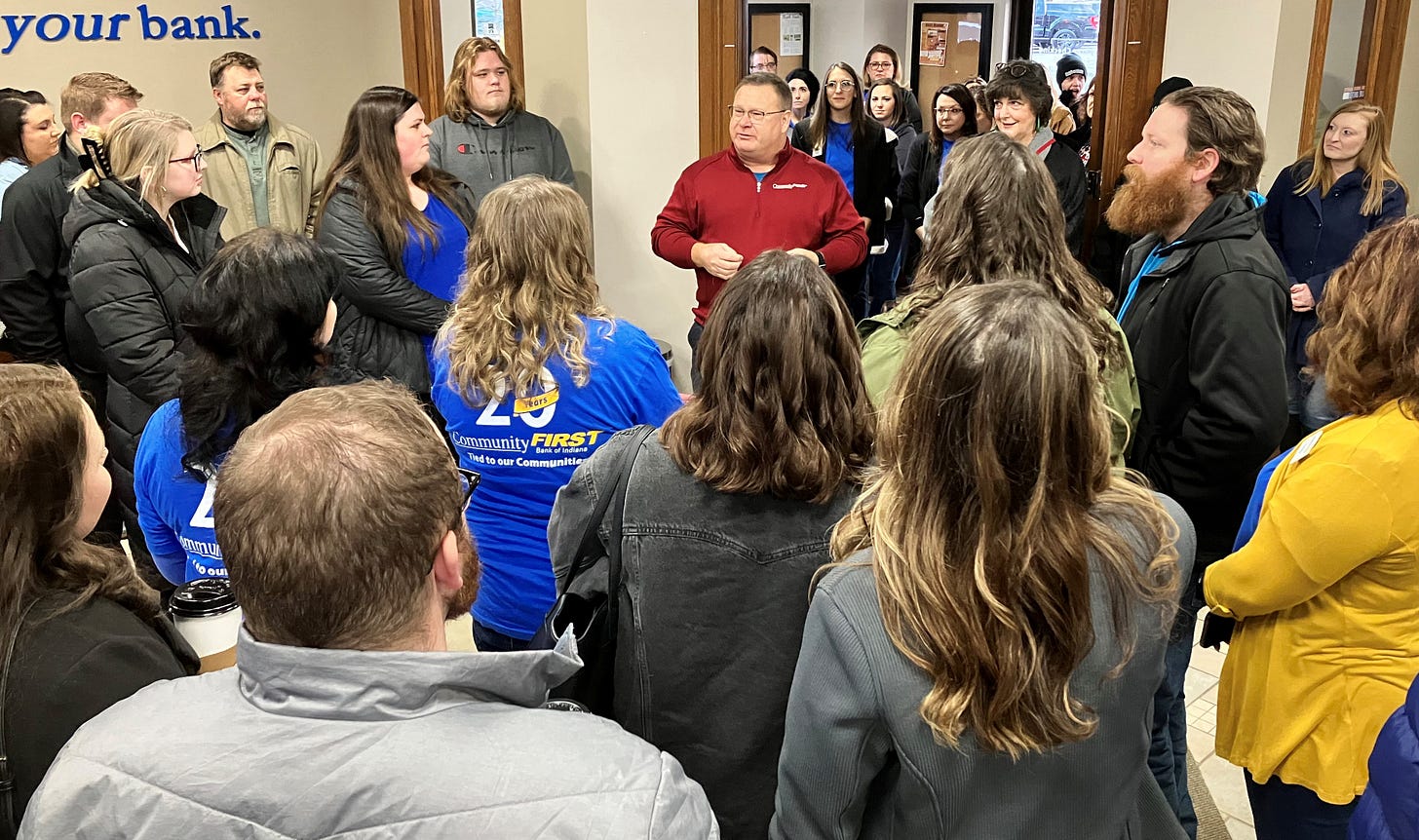

Prioritizing people allows bank to celebrate 20 years in business

Robb Blume was done with banking. He had been in the industry since graduating from school, and he wanted to do something different. So, along with his wife and another partner, he bought a pie shop. Little did he know in 2002 that he was about to embark upon one of the more remarkable banking stories in Howard County and Indiana history.

Community First Bank of Indiana was founded just a year later, on Feb. 3, 2003. And Blume found himself right in the middle of it as the organization’s Chief Credit Officer, eventually becoming President in 2013 and CEO at the beginning of 2015.

“I had purchased Moore’s Pie Shop and didn’t think I would ever get back into banking,” said Blume. “But, before I left First National Bank, I had a discussion with (former First National Bank and Community First Bank president) Mike Stegall. I said, ‘Let’s start a new bank.’ He told me, ‘I’m too old and too comfortable. I’m not interested.’

“But sure enough, a year later he called and said, ‘Hey, let’s have lunch.’ I didn’t know what it was about. He said, ‘If you’re still interested, I’ve talked to some people, and we want to start a bank.’ I agreed, and from there, we were off and running.”

Blume joined Stegall, along with the bank’s current Chief Credit Officer Bob Hickman and Chief Operating Officer Bea Wiles, to put the de novo (start-up) bank together in less than a year.

“We had a mortgage company already established, which began producing right away,” said Blume. “That was six or seven people working in the middle of a re-fi boom, so they were making mortgages. I was still working at the pie shop while trying to write policies for the new bank. But we were making loans the first day we opened the doors on Feb. 3, 2003.”

Community First became the first bank to be established in Howard County in more than 50 years, and it grew from the investment of individuals; a clear indication that the community wanted a locally owned bank. The founders had little difficulty finding people willing to invest. Told they would need $10 million to get started, they secured $13 million; without an investment bank’s involvement.

“Really it was all about dialing for dollars,” said Blume. “We called up friends and family, people we knew and had done business with, for the most part. That meant that more than 90 percent of the money we used to start the bank was local. We didn’t have any institutional investors to start; everything came from individual investors, which is pretty amazing. I don’t know that anyone has repeated the feat since.”

The vision shared by Stegall, Blume, and the management team was clear: Kokomo needed a locally owned bank that would serve as more than a bank. It needed a community partner. Community First has been that from the day it opened its doors in downtown.

“Our mantra from the beginning was hire the best people you can hire, and give back to the community,” said Blume. “If we support the community, it will support us. And Kokomo came through with flying colors. It has for 20 years, and hopefully it will continue to do so for another 20 years and more.”

Blume explained how proud he is that Community First has been involved in the growth and success of Kokomo and Howard County. It was there to assist Indiana University Kokomo and Ivy Tech Community College through its expansions. It was there to provide loans to hundreds of small businesses and families seeking to make the community their home. It was there through the worst of the Great Recession and the best of the boom times that followed.

“There are so many ways we have participated in the community,” said Blume. “But administering the PPP (Paycheck Protection Program) program in 2020 really stands out to me. We did more than 1,100 loans under that program; quite a few of them to local non-profits. And for each of those loans we made, the bank earned a fee from the government.

“As we processed the loans, I got a hair-brained idea. I approached our management team and the board about donating the fees earned on loans to non-profits back to those organizations. That meant giving about $100,000 to those institutions, which made a huge impact at a time when there was a lot of uncertainty during the pandemic.”

Community First is also there for the everyday needs their customers face. The success the bank finds at the smallest levels is something that stands out for Blume.

“There are individual things we have done that no one reads about or sees that make me really proud of Community First,” said Blume. “For instance, we recently received a letter from a customer whose spouse had passed away. All it said was, ‘Tracy Brown did a great job and made my experience as smooth as it could be. I appreciate it.’

“To take the time to write a letter during a time of loss like that says something about the service we deliver. Those little interactions mean as much as the big ones.”

Looking at the bank’s exploding growth and current stature as a business leader in Kokomo, one might think everything came easily for the organization. But Community First struggled through the Great Recession just like everyone else. Unlike its contemporaries in the banking community, however, it survived and continued to grow.

“If you look back at the financial crisis in 2008-2010, we had grown very quickly,” said Blume. “We had gone from zero to $200 million in assets in four years. If we hadn’t grown that rapidly, we might not have survived the financial crisis.

“Thank goodness, we made money every year through that crisis; not as much as we would have liked, of course. As we look back at the de novo banks that started two or three years before us or two to three years after us, I don’t believe that any of them survived in Indiana as an independent bank. They all were acquired by larger, established banks.”

That survival wasn’t accidental. Blume credited the staff and management of the bank and its board of directors for putting in long hours and making sacrifices to ensure its survival. Its connection to the community made a difference, too. As a locally owned bank with more than 275 initial investors, Community First had the freedom to act and the security of strong supporters to help it thrive.

“It really is the difference between community banking and big banking,” said Blume. “We try to be flexible and accommodate our customers. We try to make loans, not deny them. We don’t have a credit box. We can make decisions that, as long as they don’t impact the safety and stability of the bank, might be a little different than what a bigger bank might do.”

The Great Recession, however, was a different circumstance. Banks and businesses were failing across the nation at a rate not seen in a century. Community First positioned itself as a lifeline for Kokomo’s economy and did its part to keep its customers afloat.

“Because of the way we do business, we had some borrowers who struggled during the Great Recession,” said Blume. “We worked with them through that. Sometimes, banks take an attitude of grabbing the assets, liquidating them, and moving on. We didn’t do that.

“It did take us a little longer to recover from the recession, but when we did, we kept our staff together. We’ve never had a lay-off. We were ready to go. There was pent-up demand in the community, and by 2012 we saw a really strong recovery. And we started growing again.”

That growth continues today. Over the past few years, Community First Bank of Indiana has expanded beyond Kokomo and Howard County to capitalize on opportunities in Hamilton and Marion counties. Each decision to extend its reach has paid dividends.

“In 2015, Community Bank of Noblesville announced that they were going to be acquired by a larger financial institution,” said Blume. “Their bank had been helpful to us and helped us with the process of starting a bank because none of us had done it before.

“We knew once they were gone there would be a void in that market from a personnel standpoint, as working for a large bank is much different than working for a community bank. We knew there would be employees who would be looking elsewhere. And just as importantly, we knew there would be businesses and consumers that enjoyed the community banking environment.”

Blume gathered the management team and the board of directors and made the proposal to expand into Hamilton County. It met with unanimous approval. The bank started small with a loan production office, and almost immediately the people of Hamilton County asked for more – a full-service, locally-owned bank. That resulted in Community First acquiring real estate for three new branches: one in Noblesville and two in Westfield.

“Our timing was very fortunate as Westfield and the rest of Hamilton County have really taken off since then,” said Blume. “I wish I could tell you I was smart enough to have foreseen the growth those communities have undergone, but we had an idea they might. And those communities have been tremendous in supporting us.”

Community First added to its bottom line in 2020 with the acquisition of controlling interest in a mortgage company in Indianapolis, and it opened a branch on 93rd Street and Meridian Street in 2022. All of that was possible because the bank doesn’t hold itself to a pre-determined script authored a year in advance.

“One of the advantages of being a smaller, community bank is you can be more flexible and responsive when opportunities present themselves,” said Blume. “We can make decisions on what is available in front of us and not force things to comply with some pre-set plan.”

Now entering its 20st year, Community First Bank is continuing to find ways to grow. It is preparing to relocate its loan production office to Fishers, which will be accompanied by a small retail presence. Blume believes it won’t take long for the town to embrace them.

“We’ll put in an ATM to start, and more than likely it will turn into a more traditional banking facility,” said Blume. “The move gives us access to a new market. It will mean relocating some people, but we aren’t going to do that right away. We’ll do it a step at a time. We want to continue to grow.

“A lot of 2023 will depend on the economy. I thought we would see more weakness in our loan portfolio, but it is holding up very well. We forecast some really strong internal growth for 2023. We have a strong loan pipeline. We have a complete lending team, a great operations team, and great retail people.”

It is people, after all, that have meant the most to the bank’s success. The employees make all the difference, Blume contends. To that end, Community First has opted to invest in its people as a top priority this year. It hired beloved pastor Mark Malin, formerly of Oakbrook Ministries, as its Leadership and People Development Officer in order to build up the employees and help them realize success within the bank.

“Our money is green like everyone else; our rates are comparable,” said Blume. “What differentiates us is the experience people have when they deal with our employees. Finding a way to continue building our people was critical to us. That’s where Mark comes in.”

A second priority for Community First in 2023 is investing in technology. The bank is working to ensure that its customers and employees have state-of-the-art technology literally in the palms of their hands, on their phones and at their workstations.

“Operating as efficiently as we can is important,” said Blume. “We want banking with us to be easy. That takes an investment.”

Community First Bank of Indiana blazed a trail through Kokomo and Howard County as a new bank 20 years ago. It survived the worst economy seen in generations. It built up businesses, non-profits, and families with a hometown approach so many desire. But none of it was possible without the people inside and outside of the bank’s doors.

“We truly are tremendously grateful for this community and what it has allowed us to do,” said Blume. “We’re up to 127 employees. Those employees and their families, and all the people we’ve been able to provide loans to, it has been a real privilege to serve them, and we look forward to doing so for a long time to come as an independent bank.”

Learn more at www.CFBIndiana.com/20years. Member FDIC.

This was a wonderful, informative article! Thank you for presenting the great things that happen in Kokomo, and telling about the creative yet humble people involved.

I'm telling everyone to subscribe....